Overview of the Market

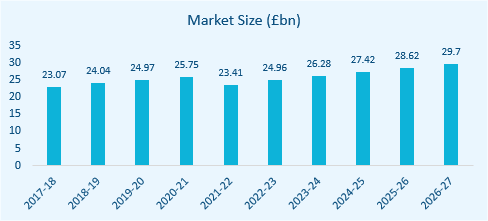

Industry revenue is projected to grow at a compound annual rate of 1.6% over the five years through 2021-22 to £25 billion. Rising advertising budgets over most of the past five-year period stimulated demand for industry services in addition to resilient consumer spending and strong growth in online advertising revenue. Also, major events like the 2018 FIFA World Cup increased demand for TV and radio advertising. However, economic concerns associated with the UK’s decision to leave the EU forced businesses to become more cautious when considering marketing budgets.

The COVID-19 pandemic caused business and consumer confidence to plunge, slashing ad spending as firms attempted to cut budgets to overcome the challenges presented by the outbreak. However, industry revenue is expected to rise by 6.6% in the current year as the quick vaccine roll-out aids economic recovery. Moreover, postponed major events, such as the 2020 Olympics, are scheduled to take place in the current year, boosting demand. Over the period, rising competition, growth in lower yield online advertising and the effects of the pandemic have weighed on profit margins, which are expected to fall to 12% in 2021-22.

Industry revenue is forecast to increase at a compound annual rate of 4.2% over the five years through 2026-27 to £30.7 billion. Rising manufacturing activity and efforts by firms to increase research and development may also boost demand, as businesses generally promote new products and services through advertisements. Although demand for online advertising services is forecast to continue to grow, the benefits to the industry are likely to be curbed by more firms dealing directly with online providers or external firms.

Market Agency Companies

The Advertising Agencies industry exhibits a low level of capital intensity. In 2021-22 for every £1.00 spent on capital equipment, an estimated £9.20 is spent on labour. The industry requires skilled staff to create and produce advertising campaigns.

The industry exhibits a high level of technological change. The rapid growth in online advertising has forced players to come up with innovative ways of advertising so that they can compete effectively against both internal and external rivals.

The industry is expected to display a moderate level of revenue volatility over the five years through 2021-22. Business confidence has suffered over the past five years due to uncertainty relating to the UK’s decision to leave the EU and also the COVID-19 pandemic, contributing to significant revenue decline in 2020-21. Economic recovery and improving market conditions are expected to aid business confidence and support industry revenue growth over the current year.

M&A Activity in the Sector

Market IQ data indicates a total of 600 significant deals in the industry from January 2011 to October 2021, with UK targets. Deals are only reported over a certain value threshold (c.£500k), therefore, it is likely that not all deals have been captured.

Upon breaking down the deal type, M&A activity within the sector is mainly categorised by acquisitions, with 495 since January 2011. There were also 62 MBOs, 29 mergers, 7 SBOs and 6 MBIs. A geographical breakdown of the deal shows that London dominates M&A activity, with 244 deals. This is likely down to the concentration of marketing agencies in the region. The remaining deals are spread through the U.K.; slowly declining in number to Wales & Northern Ireland, each with only 6 deals.

Deal flow has been significant in each year, with a steady increase through 2016 before a significant dip in 2017, this is likely characteristic of the uncertainty effect of the UK’s exit from the EU. Without the clarity that a deal will bring, UK businesses are highly likely to be risk adverse and therefore adopt protectionist strategies. With 39 deals through October 2021, forecasting the same rate to the end of the year gives 52 deals. A strong recovery versus 2020. If the 2021 trend continues, the data will likely illustrate improving confidence on the part of acquisitive businesses.

Industry Benchmarking Information – October 2021

Hallidays’ client base consists of small to lower mid-market enterprises. Our benchmarking analysis reflects businesses with turnover below £20m, in line with the majority of our clients in this sector.

| Marketing Agency Benchmarking Data | Mean | Median | Lower Quartile | Upper Quartile |

|---|---|---|---|---|

| Turnover Growth/Decline (%) | (5.68) | (7.45) | (27.67) | 10.45 |

| EBIT Margin (%) | 4.76 | 4.59 | (4.55) | 12.96 |

| EBIT Growth/Decline (%) | (4.76) | (2.16) | (70.99) | 65.67 |

| EBITDA Margin (%) | 6.65 | 6.75 | (2.00) | 14.95 |

| EBITDA Growth/Decline (%) | 4.59 | 1.80 | (65.03) | 68.88 |

| Total Net Assets Growth/Decline (%) | (0.81) | 3.15 | (27.85) | 23.98 |

| Current Ratio | 2.51 | 1.43 | 0.95 | 2.39 |

| Acid Test | 2.49 | 1.42 | 0.94 | 2.36 |

Market Research Benchmarking

Using full company accounts filed in the last two years under the SIC-Code “73 Advertising and market research”. Excluding companies with nil turnover in either period, we have summarised key benchmarking information for businesses under £20m turnover in the table above. October 2021.

M&A Activity Source

Experian Market IQ (October 2021)

Search Criteria: SIC-Code “73 Advertising and market research”