Overview of the Market

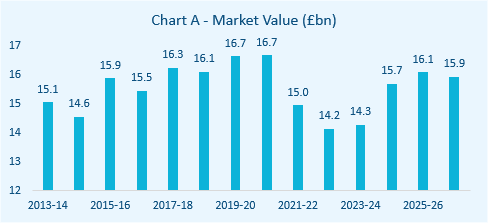

The Heating, Ventilation and Air Conditioning (HVAC) UK market is estimated to be worth approximately £15.0bn with a compound annual growth rate of -0.7% through 2016-21. Growth opportunities in the commercial and industrial HVAC and plumbing markets have been limited, whilst the competitive nature of the HVAC and plumbing market could force contractors out of the industry. However, government initiatives to stimulate the housing market, such as the ‘help to buy’ scheme have somewhat supported demand for industry services.

In 2020-21, revenue is expected to decline by 10.4%. This is presumed to be almost exclusively due to the COVID-19 pandemic and the effect market disruption has had on new business volumes and cashflow. However, the essential nature of HVAC, in order to keep utility systems safe and in working order, should somewhat safeguard any significant industry decline.

Over the five-year period through 2025-26, revenue is expected to increase at a compound annual rate of 1.3% to reach £15.9 billion. However, this more so reflects tentative market recovery as downstream markets correct and demand for HVAC and plumbing installation returns to a more normal level. Going forward, competitive pressures will likely remain, yet pockets of growth should be ever-present in the market renewable energy installations.

Market Share

The three major players in the market are as follows (Estimated):

- Centrica Plc (British Gas): 11.5%

- Home Serve Membership Ltd: 2.1%

- T Brown Group Ltd: 0.3%

Operating Conditions

Capital intensity within the industry is low. It is estimated that operators in the Plumbing, Heating and Air Conditioning industry spend £17.00 on labour for every £1.00 they invest in capital. The principal value added by the industry is the provision of skilled labour and technical knowledge. The majority of industry services require manual labour and employees require a substantial amount of training before commencing work.

Technological changes in the industry are slow as developments tend to occur in upstream manufacturing industries. Operators have been required to upskill and offer a higher level of online customer service to customers demanding further technological integration.

Revenue fluctuations are largely influenced by construction levels. This means that the industry has displayed a moderate level of revenue volatility as construction is contingent on wider economic conditions. Recent growth has been supported by increased government pledges to build more housing in the country along with schemes such as Help to Buy.

M&A Activity in the Sector

Market IQ data indicates a total of 195 significant deals in the industry from January 2011 to July 2021, with UK targets. Deals are only reported over a certain value threshold (c.£500k), therefore, it is likely that not all deals have been captured. Data consists solely of Acquisitions, Management Buy-outs, Management Buy-ins and Secondary Buy-outs.

Upon breaking down the deal type, M&A activity within the sector is mainly categorised by acquisitions, with 147 since January 2011. There were also 41 MBOs, 3 MBIs, 3 SBOs and one merger. A geographical breakdown of the deals shows that the South East dominates M&A activity, benefitting from 33 deals in the time frame. The North West was close behind with 27 deals being completed. The rest of the deals are spread throughout other regions whilst slowly declining to Northern Ireland with only 3 deals.

Deal flow within the industry is quite volatile, with market transactions surging in 2020. This high volume of M&A transactions could be reflective of the quality of the deals currently occurring in the UK market. However, in 2021-22, the coronavirus pandemic has caused construction output and new orders to drastically decline. Accordingly, this reduced potential buyers’ propensity to invest. Forecasting ahead to the end of the year following current trends gives only 12 deals, a large reduction when compared to 2020.

Industry Benchmarking Information – July 2021

Hallidays’ client base consists of small to lower mid-market enterprises. Our benchmarking analysis reflects businesses with turnover below £20m, in line with the majority of our clients in this sector.

| HVAC Benchmarking Data | Mean | Median | Lower Quartile | Upper Quartile |

|---|---|---|---|---|

| Turnover Growth/Decline (%) | (1.08) | (0.76) | (19.79) | 11.70 |

| EBIT Margin (%) | 3.00 | 3.21 | (1.14) | 9.40 |

| EBIT Growth/Decline (%) | (4.87) | (9.78) | (61.81) | 55.54 |

| EBITDA Margin (%) | 5.28 | 4.58 | 0.27 | 10.77 |

| EBITDA Growth/Decline (%) | (4.33) | (8.53) | (53.19) | 49.42 |

| Total Net Assets Growth/Decline (%) | (6.16) | 3.22 | (30.44) | 17.67 |

| Current Ratio | 2.03 | 1.55 | 1.10 | 2.46 |

| Acid Test | 1.87 | 1.43 | 0.95 | 2.25 |

HVAC Benchmarking

Using full company accounts filed in the last two years, excluding companies with nil turnover in either period.

Search criteria: Keywords concerning HVAC

October 2018.

M&A Activity Source

Experian Market IQ (July 2021)

Search Criteria: Keywords concerning HVAC.